Why ETFs can outperform mutual funds - by a lot

- Fees Matter — ETFs typically have very low expense ratios. Passive index-tracking ETFs like SPY don’t require expensive active management, so you keep more of the returns. Fidelity+1

- Underperformance Is the Norm for Active Funds — Data show that 80–90% of actively managed U.S. equity funds underperform their benchmark over a 10-year horizon. Apollo Academy+2Institutional Investor+2

- You Get the Whole Market, Not Bets — With an ETF like SPY, you own hundreds of the largest U.S. companies in proportion to their size. That means you automatically “catch” the biggest winners — something mutual funds often miss with stock-picking bets.

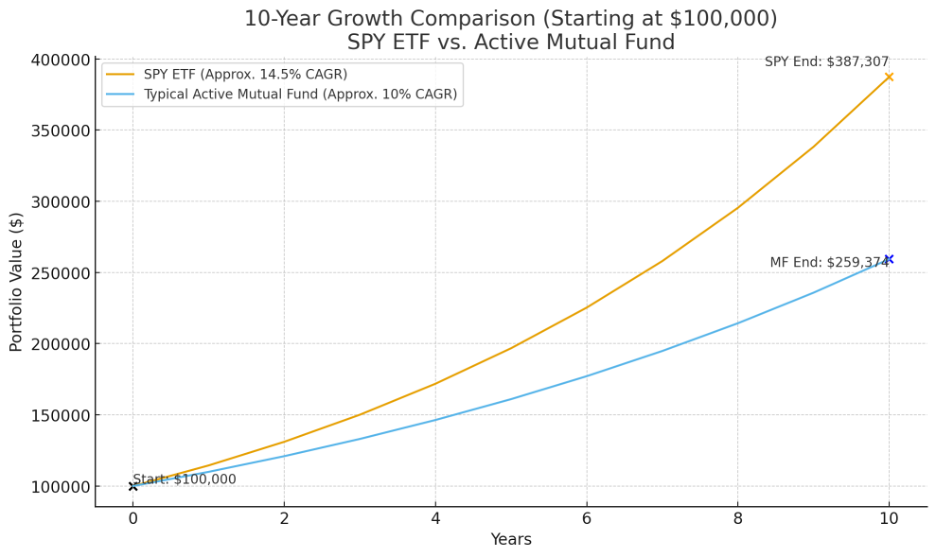

✅ Starting values for both at $100,000

✅ Ending values for both SPY and the mutual fund

- SPY End Value: ~$387,307

- Mutual Fund End Value: ~$259,374

This visually show how a higher-performing, lower-fee ETF compounds dramatically better over 10 years vs. the average mutual fund.