MSFT Valuation Update - On DCF stock looks fairly valued

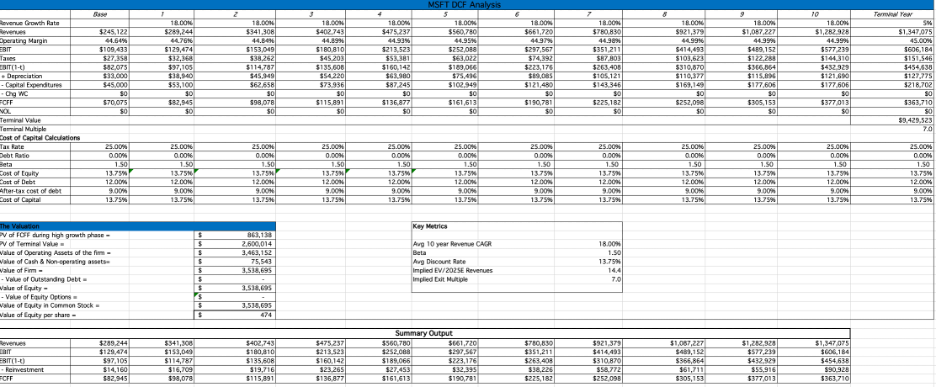

Our 10-year DCF analysis (see snapshot below) indicates that Microsoft shares are fairly valued at current levels. Using an average revenue CAGR of 18% over the next decade, we forecast robust long-term growth consistent with Microsoft’s scale and competitive position. Applying a 13.75% discount rate—derived from a 1.50 beta and reflecting the company’s risk profile—yields a fair value estimate of $474 per share, only modestly below the current market price of $490. This narrow valuation gap suggests that the market is appropriately pricing in Microsoft’s durable growth trajectory and strong cash-flow generation.

Our assumptions imply an EV/2025E revenue multiple of 14.4x and a long-term exit multiple of 7.0x, both of which align with historical trading ranges for large-cap, high-quality technology companies. These multiples reflect the balance between Microsoft’s leading positions in cloud, productivity software, and AI—areas that continue to drive above-market growth—and the natural valuation compression expected as the company matures. Given that our intrinsic value estimate sits close to the prevailing share price, we believe Microsoft is fairly valued, with upside dependent on sustained AI monetization and outperformance relative to already-strong market expectations.